9 rows GST code Rate Description. While making tax payment through various tax payment options taxpayers have to specify a few information such as Name of TaxpayerEmployer Income tax numberEmployer number Identity number and Payment Code.

Gst Tax Codes Rates Myobaccounting Com My

Malaysia GST Tax Codes.

. However I notice SAP use only A for output tax and V for input tax. 10 rows A GST registered supplier can zero-rate ie. To view the GST Tax Codes in MYOB open your company file then click.

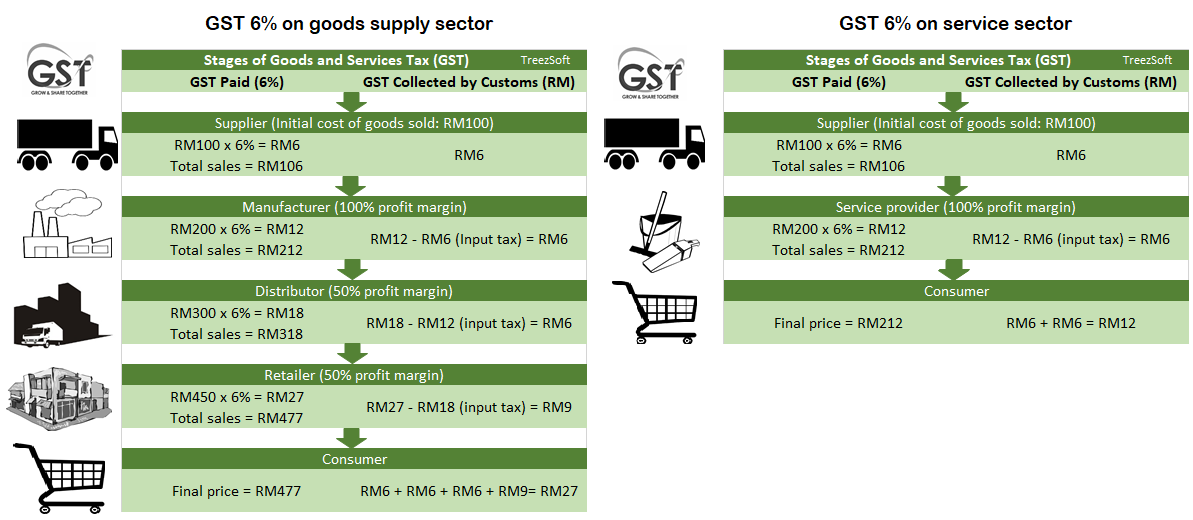

GST is a multi-stage tax on domestic consumption. Approved Trader Scheme ATMS Scheme. Claim for input tax.

Refers to all goods imported into Malaysia which are subject to GST that is directly attributable to the making of taxable supplies. Purchase of fixed assets with GST. Charging GST at 0 the supply of goods and.

Non-applicability to certain business. The fixed rate is 6 and some types of goods and services can be exempt from this tax while others are taxed at different rates. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

GST code Rate Description. GST on import of goods. Malaysia GST Reduced to Zero.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Payment code is referring to the type of tax that categorized by Inland Revenue. Tax codes determine how much tax is due for each transaction.

Malaysia GST Reduced to Zero. What is the GST treatment and tax code that need to be used for such supply. Overview of Goods and Services Tax GST in Malaysia.

There are 23 tax codes in GST Malaysia and categories as below. The two reduced SST rates are 6 and 5. Segala maklumat sedia ada adalah untuk rujukan sahaja.

Input Tax 6 Import of Capital Goods. For more information regarding the change and guide please refer to. GST Tax Codes in MYOB.

The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. Imports under special scheme with no GST incurred eg. Import of goods with GST incurred.

It applies to most goods and services. In the Malaysia government website the GST tax type proposed is GST. Secondly I notice the GST tax code listing have 2 3 or 4 characters however SAP standard provided 2 characters tax code only.

Meaning of longer period. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

The sales tax rate is at 510 or on a specific rate or exempt. Purchases with GST incurred at 6 and directly attributable to taxable supplies. GST is calculated on CIF Cost Insurance and Freight Customs Duty payable.

So should I create a new tax type GST for this purpose. It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. Yes if the purchase was made 3 months before the tourist departs from Malaysia.

Any business with a yearly turnover in excess of MYR 500000 is required to register for VAT in this country. GST is charged on all taxable supplies of. GST is suspended on the importation of goods made by a ATS holder.

Treatment of input tax attributable to exempt financial supplies as being attributable to taxable supplies. GST should be charged at standard rate of 6 and the tax code to be used is SR 6. For more information regarding the change and guide please refer to.

In 2017 chief economic advisor estimated that the Revenue Neutral Rate RNR the average GST rate to ensure that GST collected is equal to the central and state tax revenue subsumed within GST. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018. Disallowance of input tax.

VAT in Malaysia known as Sales and Service Tax SST was introduced on September 1 2018 in order to replace GST Goods and Services Tax. Attribution of input tax to taxable supplies. Exported manufactured goods will be excluded from the sales tax act.

The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. What is the treatment. 8 rows GST on purchases directly attributable to taxable supplies.

Export of goods from Malaysia to Designated Areas. Income Tax Real Property Gains Tax RPGT Payment. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018.

Malaysian sales and service tax. Sales Tax and Service Tax were implemented in Malaysia on 1 September 2018 replacing Goods and Services Tax GST. Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia.

Tax Code Table Proline Documentation

Yyc Advisors Recommended Gst Tax Code Listings For Supply Source Accounting Software Enhancement Towards Gst Compliance Revised As At 18 July 2016 By Customs Facebook

Sales Service Tax Sst Qne Software Sdn Bhd

Understanding Tax Codes In Sql Account

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

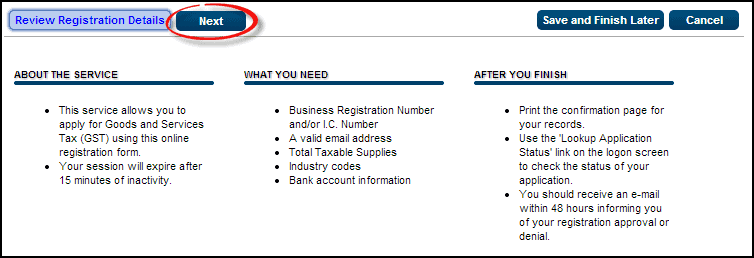

Step By Step Guide To Apply For Gst Registration

Reimplementing Gst Is Best Measure To Revive The Nation S Revenue Economist

Newsletter 67 2018 Information Required For Extension Of Time To Account For Gst Output Tax Page 001 Jpg

A Complete Guide On Gst Rate On Food Items Ebizfiling

Gst Rates 2022 List Of Goods And Service Tax Rates Slab Revision

Degree Certificate That Cost Almost Rm50 000 From Sheffield Truly Proud Of It As I Use It To Degree Certificate Fake High School Diploma University Diploma

Tax Codes In Myob Goods Services Tax Malaysia

The Amount Of Monthly Gst Collections Has Reached Trillion Marks For The First Time Since The Beginning Of Gst Registration Which Ind Trillion Marks Banksters

Goods And Services Tax Gst In Malaysia 3e Accounting

Newsletter 22 2019 Gst Guide On Transition Issue Page 001 Jpg

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Gst Rates In Malaysia Explained Wise

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Goods And Services Tax Gst In Malaysia 3e Accounting